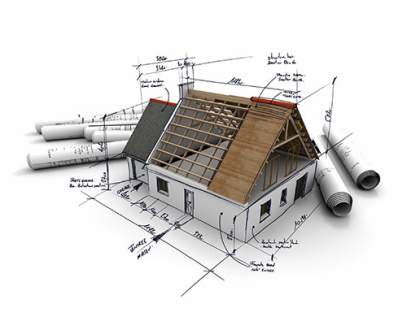

Financing for Residential Construction Loans in Florida

Opting for a new construction loan for building your dream home over a conventional mortgage loan for an existing home purchase has its advantages. From the ability to customize the home to lower repair and utility costs, Florida construction loans sometimes just make more sense.